I guide families to gain financial confidence to take control of their lives and guide them towards financial independence.

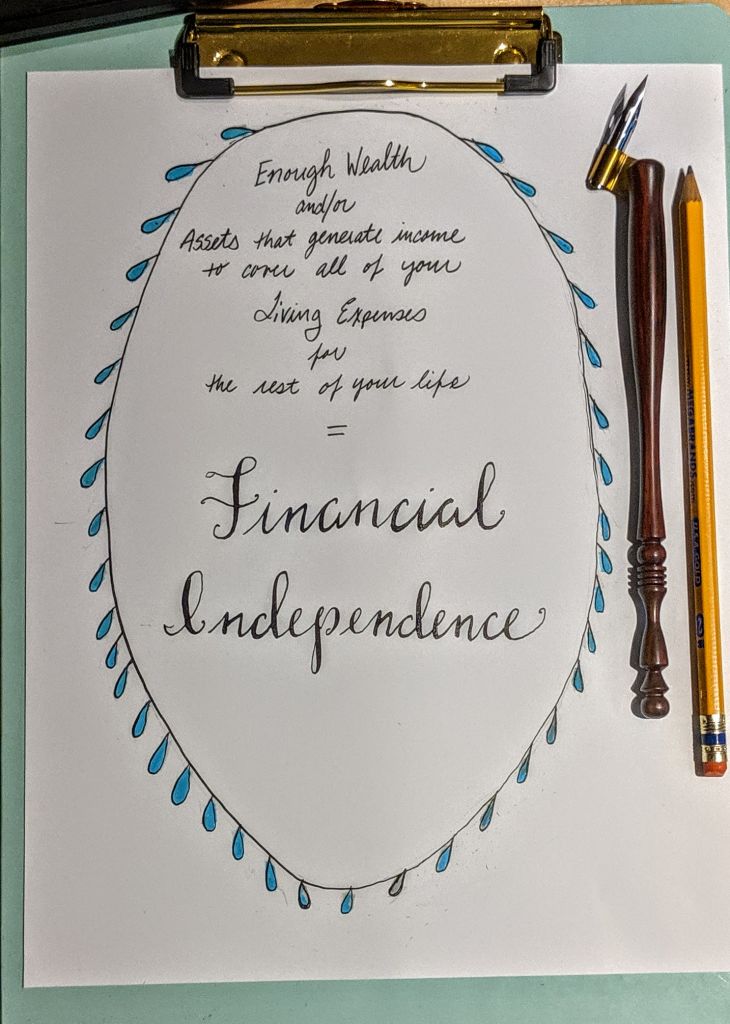

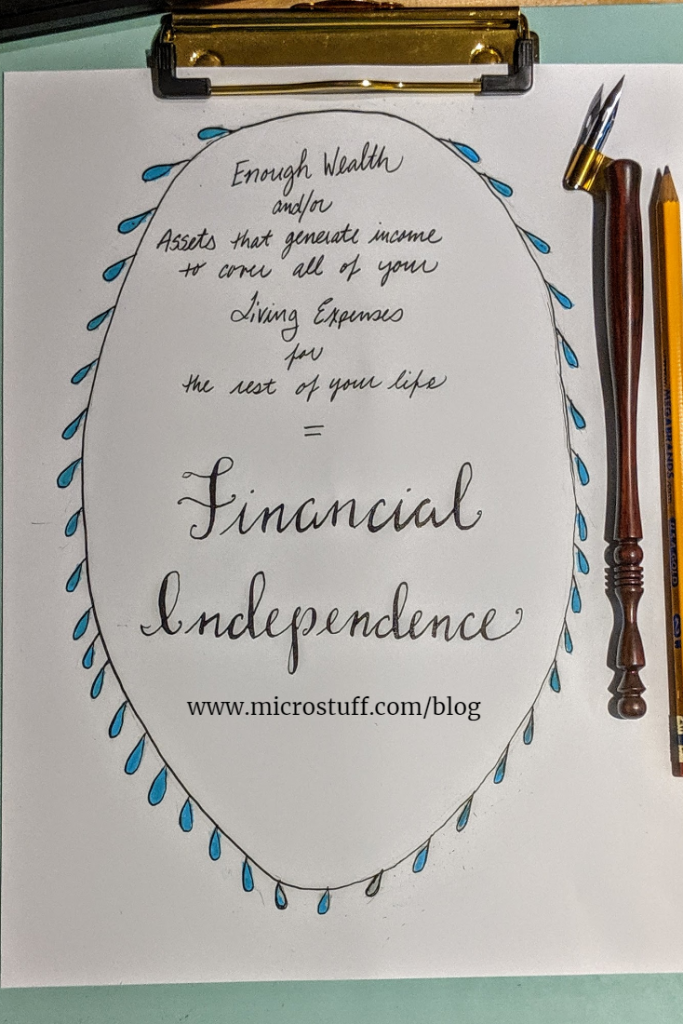

What is financial independence?

Financial independence means you have enough wealth and/or assets that generate income to cover all of your living expenses for the rest of your life.

It really means freedom to do what you want and to have enough wealth to live on without having to work.

What do you mean? “Have enough wealth to live on, without working?”

Wealth is the money and/or assets that you have saved and invested.

Financial Independence is living off the money that you accumulated say in cash, selling stocks and bonds and/or income that comes in from rental property that you own or a passive business that you own.

The point is that wealth and/or income covers all of your expenses without having to work again.

There are many ways to reach it.

You have to think outside the box.

However, this isn’t a get rich over night scheme.

This takes time and hard work.

You know what, this has been taught for years. This isn’t a new concept at all.

Here are great books that emphases the teaching of creating wealth and living on it:

Your Money Or Your Life, by Joseph R. Dominguez, Monique Tilford, and Vicki Robin

The Richest Man in Babylon: Original 1926 Edition – by George S. Clason

How to Stop Worrying and Start Living – by Dale Carnegie

Think and Grow Rich – by Napoleon Hill (Author), Arthur R. Pell (Contributor)

Disclosure: This post may includes affiliate links. Thanks for supporting Microstuff.com.

It may seem impossible, when you first think about having enough wealth to live on.

Some thoughts I had when I first heard of this concept:

- That can’t happen until someone is 65 or 70 years old.

- That only happens to someone who sold a company for millions.

- That happens to someone who inherited money from their family.

- Biggest thought you may have is that can’t happen for me and my family.

To be honest those thoughts are ALL wrong!

- Saving our income above 20%

- Investing our savings

- Naturally, living a frugal lifestyle which means living within our means

- Paying down debt

- Accumulating Wealth

Wealth and Income don’t mean the same thing.

Income is defined as money you earn right now.

There are so many ways to define Income:

- W2 paycheck

- Rental income

- Selling items through a Business

- Providing a service through a Business

- Even writing for a blog and earning money from advertising

Wealth is money and assets you keep and build over time. This is the money you save and invest and it grows.

The way to look at financial independence and make it achievable it is a change in mind-set. It doesn’t matter where you are in life you just have to start.

- Cutting Expenses

- Increasing Income

- Saving and then investing (this can be in the stock market and/or other assets like real estate and bringing in the rent income as passive income.)

After you have enough working assets that you have accumulated you don’t need to work again.

Here you can sign up for my free Financial Checklist .pdf worksheet so you can print it out and enter in all of your details to find out what you have now. This is a great exercise to do each year.

How much do you really need to be financially independent?

Expenses! It is all about your expenses. The fact is it really depends on expenses. To get started you have to find out what your true expenses are and to look at your over all financial health.

If your expenses are low you don’t need as much to invest and save up. If your expenses are high then you have to save and invest more so that you can live that lifestyle.

The main calculation that is focused on in the Financial Independence space is the 4% rule but it is a rule of thumb which is based on the Trinity Study which has since been updated in 2011. Some bloggers and advisers suggest using 3% while some may even suggest more than 4%. I highly recommend talking to a flat fee-only advisor to go over these numbers for your particular situation.

What do these things mean?

The suggested idea by advisers and planners is to take 4% of your assets the first year and then each year after that (adjusted for inflation).

(annual expenses) * 4% = Financial Independence number

Let’s do an example:

Let’s say you estimate you look at your true expenses and feel comfortable saying you can live on $60,000 a year. This covers everything that you estimate including housing, food, clothing, entertainment, taxes and healthcare.

$60,000 * 25 = $1,500,000

$60,000 * 30 = $1,800,000

$60,000 * 35 = $2,100,000

This is the Financial Independence number.

Now, you try it.

Take your expenses and multiple it by 25, 30 and 35.

—————————- X 25 = —————————-

—————————- X 30 = —————————-

—————————- X 35 = —————————-

If you are younger you may want to consider more in that number vs someone in their 60s, 70s, and 80s.

How do I save and invest to reach that number?

Having a higher savings rate is what you need. You can’t save and invest on a low savings rate. You may start at 5% or 10% or even 20% savings rate but to get there faster you need to challenge yourself and work towards a 30%, 40%, or even 50% savings rate. I understand tax rates and high cost of living can affect these savings rates.

Investing in your companies 401k, a Traditional IRA and/or a Roth IRA is very important because of tax advantages as well as the investing opportunities. There is a lot of information on investing available to do it yourself or from flat fee-only financial advisors.

Increase your income.

You should always be looking at ways to increase your income so you can then increase your savings rate.

Plus, it is a great motivator to then focus on increasing your income.

There are ways to do that within your own day job like raises, and promotions. Or by looking at other ways like:

- Selling items

- Having another part-time job like babysitting, or dog walking.

- Working on a hobby that makes money

Financial Independence doesn’t mean you have to retire. It gives you the option to. The option to live the life you want. The option to work or the option to not.

For example: Say you want to travel for a month or two with your family while the kids are young. Maybe leave your job for a couple of months and then look for a different job when you get back. You have that flexibility when you are financially independent.

What if you don’t like your job and you want to try something different like build a business. You can try that.

Or try a different career that you wish you had done years ago. You may be surprised and earn more income doing so.

Or you may not want to make money and instead spend your time helping others and helping your community. You could volunteer your time helping all sorts of causes. It is a win win!

The possibilities are endless when you are financially independent. The idea is you don’t have to limit yourself.

What is stopping you from reaching financial independence?

Back to what I do. I guide families to gain financial confidence to take control of their lives and guide them towards financial independence.

I teach and guide you to figure out your own path.

- Some will start later at the game and that is ok. It’s better to get started then to not start at all.

- Some will have debt. This is very common and it isn’t the end of the world. You can pay it down.

- Some will have complications with their family situation. This is more common then one might think.

- Personal finance is of course personal so everyone has a different path and passion.

What is your passion? What are your dreams?

I personally grew up loving volunteering my time to help others whether that was to raise money for a good cause, or helping with a volunteer project or supporting a like minded group. I still do! It’s in my blood. It is a passion of mine.

Instead of feeling stuck about your finances and situation take control and change your life and work towards your own path to financial independence. This is how a coach like myself can help.

FraidyCat Finance says:

What to do if you don't have an Emergency Fund? - Microstuff says:

Jessica Medina says: